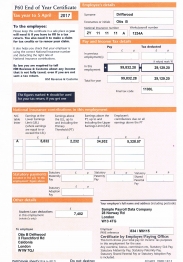

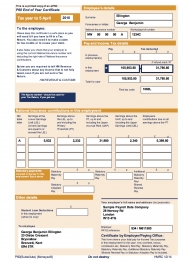

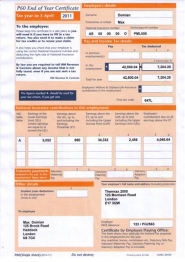

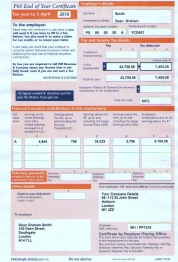

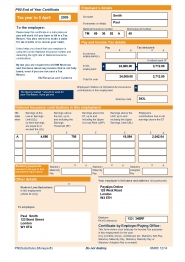

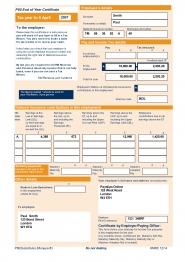

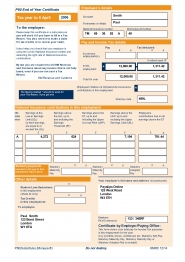

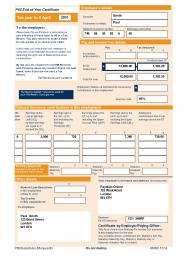

P60's

P60 FORM Online

Replacement P60 Form Online

Those times when you have lost P60 Form or damaged such an important payslip, you need a Replacement Payslip. So when you hire a company for a replacement P60 form please check that it gives you a replacement payslip with tax rebates of the previous year, along with deductions calculated past year as government changes tax rebates. Thus it is necessary that payroll systems are updated to get accurate Gross pay and tax rebate. The advantage of using our payslip services is you will get accuracy and expertise.

Our payroll system is always updated so that your salary and tax deduction calculations are always accurate. We have experts who manage the payroll system to give you Accurate P60 online. You can even get replacement P60 from our company in a timely manner. Further, we have the extensive knowledge about payroll and latest updates in taxation to show you the accurate Gross pay and calculate the right tax as well as waiver tax for your expenses. Get Order P60 Form Online for your employees and save your time and money to buy your own payroll system.

P60 form summarizes all your payslips received in a particular year. It represents your total pay, total tax paid by you and the National insurance number. Again, it is an important P60 form that you must keep safely to have a record of your annual payment. It is required by many law and tax authorities. You can also order Payslips Online along with your P60 Form. We have full Range of P60 Online from 2003-2017. You can order P60 for the year P60 for 2021-22, P60 for 2020-21, P60 for 2019-20, P60 for More years.

You will receive it from your employer at the end of tax year, i.e. 31 May to complete the tax return and claim repayment. But under one circumstance you might not get the Replacement P60 form from your employer. It is when you decide to leave your employment in the current organization during the tax year as all the necessary information would already be listed in P45 form.